All Categories

Featured

Table of Contents

If you quit paying your costs, you will normally incur late costs, penalty interest and other costs, and creditors will likely step up their collection initiatives versus you. In many cases, the financial debt negotiation company will certainly be unable to work out all of your financial obligations.

You may be billed fees for utilizing this account. Dealing with a financial debt negotiation business may cause a financial institution filing a debt collection legal action against you. Unless the financial obligation negotiation firm resolves all or a lot of your financial debts, the built-up charges and costs on the unclear financial obligations might erase any savings the financial debt settlement firm attains on the financial obligations it settles.

Local Initiatives That Offer Financial Assistance Fundamentals Explained

Warning: Debt negotiation may well leave you deeper in the red than you were when you began. The majority of debt negotiation business will ask you to stop paying your financial obligations in order to get creditors to work out and in order to collect the funds required for a negotiation. This can have an adverse effect on your credit rating and might cause the creditor or financial obligation collector filing a suit while you are collecting funds needed for a negotiation.

Individuals might represent themselves in bankruptcy court or consult a bankruptcy attorney if they feel they need to seek this option. In a Chapter 7 bankruptcy, the individual might need to sell several of their properties to pay a part of the arrearage. In a Chapter 13 personal bankruptcy, the court restructures the impressive financial obligations so the individual might pay all or some of the agreed-upon equilibrium over three to 5 years.

Secured financial debt, like a home mortgage, which includes collateral (typically the funded residence), and unsafe financial obligation, like debt card financial debt, are dealt with in a different way during an insolvency. And there are numerous sorts of bankruptcies, so make certain to study which alternative might be best for your situation.

The Single Strategy To Use For Reviewing Debt Relief Companies in the Industry

In order for this to work, you need to allot a designated amount of money every month that will certainly be made use of to make the negotiation deal to your lenders. However similar to various other forgiven debt, the quantity you don't pay might trigger a tax bill. It's likely you'll have damages to your credit report because few providers will discuss with you if you're current on your repayments.

Another alternative that people can look at is applying for Phase 7 insolvency. Personal bankruptcy filings halt collection actions and legal actions, and a Phase 7 declaring can legally remove financial obligation and end garnishments. To discover debt alleviation choices, complete our type or, even better, call us now and we'll match you with the most effective option for your circumstance absolutely free.

The Definitive Guide for Unsecured Debt Financial counseling for veterans in South Carolina who have multiple high interest debts Demystified

So, do not struggle any longer. Provide us a telephone call. When life occurs, we're below for When Life Occurs 844-402-3574 Table of Component Credit scores card financial debt forgiveness is an economic relief choice that enables people dealing with high balances to have a portionor, in uncommon cases, the entiretyof their financial debt eliminated.

Unlike bankruptcy, which is a legal procedure, or debt settlement, which includes paying a bargained quantity, financial obligation mercy means the loan provider cancels a part of what you owe. For consumers sinking in debt card financial obligation, this can be a lifeline. Nonetheless, it's essential to comprehend exactly how it functions, that qualifies, and the possible drawbacks before seeking this alternative.

This is generally reserved for severe situations where a borrower is monetarily incapable of settling the total. Some charge card firms offer programs where they decrease or forgive component of the debt for debtors that are having a hard time as a result of job loss, medical emergencies, or other economic crises. This entails working out with creditors to pay a decreased amount in exchange for closing the account.

How Denying to Pursue Bankruptcy Counseling Causes Things Worse Can Be Fun For Anyone

: When a debt is forgiven, debt collection agency have no claim on that amount.: For those sinking in the red, mercy supplies a chance to reset their financial resources and begin reconstructing their credit.: In most cases, forgiven financial obligation is considered gross income by the IRS, which suggests you could wind up with an unexpected tax expense.

Plus, if a loan provider forgives a part of your financial debt, they might still require partial settlement. Not all debt is forgiven the very same method. Some loan providers supply organized difficulty programs, while others might just think about mercy if you go after negotiation or insolvency.

This is not a typical practice, and it generally takes place under particular circumstances, such as: (job loss, disability, clinical emergency situation). (lenders may write off old debts as uncollectible). where a borrower pays a minimized amount for the rest being forgiven.: A loan provider decreases the total quantity owed, however you still need to pay a portion.

Lenders prefer negotiation over outright forgiveness because it guarantees they recoup some of the money. Debt mercy is usually a last resort when they think there's no chance of full settlement.

Not known Factual Statements About Value to Invest in Professional Financial counseling for veterans in South Carolina who have multiple high interest debts

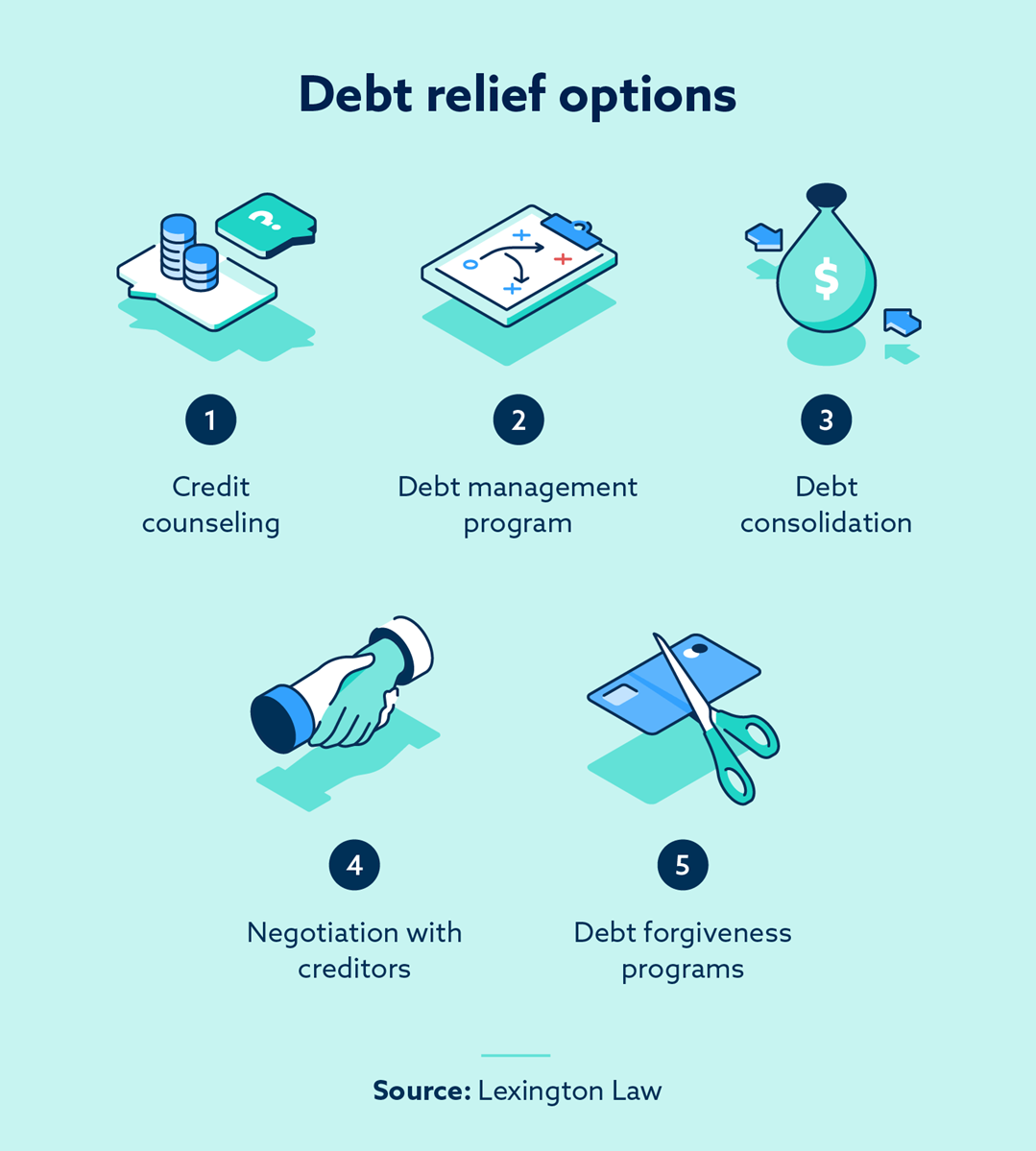

: Nonprofit credit score counseling companies, such as those affiliated with the National Foundation for Credit Rating Counseling (NFCC), help consumers recognize their economic options and guide you to a program that best fit your situation.: A DMP is not specifically debt mercy, but it allows customers to repay financial debts on a lot more positive terms, typically at reduced rates of interest.

Charge card debt forgiveness programs normally focus on customers experiencing significant financial difficulty. Qualification standards typically include job loss, medical emergencies, or special needs leading to revenue loss. A high debt-to-income (DTI) ratio, showing a huge section of revenue devoted to debt repayment, is another typical variable. Programs may likewise take into consideration situations where necessary expenses, such as medical bills or basic living prices, surpass revenue, developing uncontrollable financial stress.

Table of Contents

Latest Posts

A Biased View of Questions to Ask Any Bankruptcy Counseling Service

Consumer Protections When Pursuing Financial counseling for veterans in Alabama who feel stuck making only minimum payments - The Facts

Some Known Details About How Modern Tools Transforming Debt Counseling

More

Latest Posts

A Biased View of Questions to Ask Any Bankruptcy Counseling Service

Some Known Details About How Modern Tools Transforming Debt Counseling